Diving into the world of global investment trends, we uncover the dynamic landscape that shapes the financial markets worldwide. From the ever-evolving strategies to the impactful factors driving these trends, this guide offers a captivating insight into the realm of international investments.

As we delve deeper, we’ll explore the different types of global investments, the role of emerging markets, and the growing significance of sustainable investing in today’s financial climate.

Overview of Global Investment Trends

Investing globally has become increasingly popular as investors seek to diversify their portfolios and capitalize on opportunities in various markets around the world. Understanding the key factors driving global investment trends is crucial for making informed investment decisions.

Factors Driving Global Investment Trends

- Technology advancements: The rise of technology has made it easier for investors to access global markets and trade securities instantaneously.

- Emerging markets: Countries with growing economies and markets present attractive investment opportunities for higher returns.

- Globalization: The interconnectedness of economies has increased the flow of capital across borders, influencing investment trends.

Impact of Geopolitical Events on Global Investment Trends

- Political instability: Uncertainty caused by geopolitical events such as trade wars or conflicts can lead to market volatility and impact investment decisions.

- Regulatory changes: Shifts in regulations and policies in different countries can affect investment opportunities and risk profiles.

- Currency fluctuations: Changes in exchange rates due to geopolitical events can influence the value of investments in foreign markets.

Comparison of Historical and Current Global Investment Trends

- Historically, global investment trends were more focused on developed markets, while current trends show a shift towards emerging markets.

- Technological advancements have revolutionized the way investments are made, making it easier for retail investors to participate in global markets.

- The impact of geopolitical events on investment trends has always been present, but the speed at which information travels now amplifies their effects.

Types of Global Investments

Investing globally offers a variety of options for individuals looking to grow their wealth. Understanding the different types of global investments, along with the associated risks and successful strategies, is crucial in making informed decisions.

Stocks

Stocks represent ownership in a company and are traded on stock exchanges worldwide. While they offer the potential for high returns, they also come with high volatility and risk, as stock prices can fluctuate based on various factors such as economic conditions, company performance, and market sentiment.

Bonds

Bonds are debt securities issued by governments or corporations to raise funds. They are considered less risky than stocks, but they offer lower returns. The risks associated with bonds include interest rate risk, credit risk, and inflation risk. Investors may choose to diversify their portfolio by including bonds for stability.

Real Estate

Investing in real estate involves purchasing properties to generate rental income or capital appreciation. Real estate investments can provide a steady income stream and serve as a hedge against inflation. However, they also come with risks such as property market fluctuations, maintenance costs, and liquidity issues.

Commodities

Commodities include raw materials such as gold, oil, and agricultural products that are traded in global markets. Investing in commodities can help diversify a portfolio and provide protection against economic uncertainties. However, commodity prices can be volatile and influenced by factors like supply and demand, geopolitical events, and weather conditions.

Successful Global Investment Strategies

Successful global investment strategies often involve diversification, risk management, and a long-term perspective. For example, a strategy that combines stocks, bonds, and real estate can help spread risk across different asset classes. Additionally, active monitoring of investments and adjusting the portfolio based on market conditions can lead to better outcomes.

Role of Technology in Global Investments

Technology plays a significant role in shaping global investment trends by enabling faster and more efficient trading, access to real-time market data, and the rise of online investment platforms. Robo-advisors and algorithmic trading have become more prevalent, providing investors with automated investment solutions and personalized advice. The use of artificial intelligence and big data analytics has also enhanced decision-making processes in global investments.

Emerging Markets and Global Investment

Emerging markets play a crucial role in global investments, offering investors the potential for high growth and returns.

Significance of Emerging Markets

Emerging markets are economies that are experiencing rapid industrialization and growth, presenting unique investment opportunities for those willing to take on higher risks.

- Emerging markets often have lower labor costs, abundant natural resources, and a growing consumer base, making them attractive for investors looking to diversify their portfolios.

- Investing in emerging markets can provide access to industries and sectors that are not as prevalent in developed markets, opening up new avenues for growth and profit.

Risks and Rewards of Investing in Emerging Markets

Investing in emerging markets comes with its own set of risks and rewards that investors need to carefully consider.

Currency fluctuations, political instability, and lack of transparency in regulations can pose challenges for investors in emerging markets.Risks:

Higher growth potential, attractive valuations, and untapped market opportunities can lead to significant returns for investors who are willing to navigate the risks.Rewards:

Comparison between Developed Markets and Emerging Markets

When comparing investment opportunities between developed and emerging markets, investors need to weigh the pros and cons of each.

- Developed markets offer stability, established infrastructure, and lower risks, but they may have limited growth potential compared to emerging markets.

- Emerging markets provide higher growth potential, access to new markets, and diversification benefits, but they come with higher risks and volatility.

Strategies for Leveraging Opportunities in Emerging Markets

To leverage opportunities in emerging markets effectively, investors can adopt certain strategies to manage risks and maximize returns.

- Diversification: Spreading investments across different emerging markets can help reduce risks associated with any single country or region.

- Research and Due Diligence: Conducting thorough research on the political, economic, and regulatory environment of emerging markets is crucial for making informed investment decisions.

- Long-term Perspective: Taking a long-term view when investing in emerging markets can help investors ride out short-term volatility and benefit from the growth potential over time.

Sustainable Investing and Global Trends

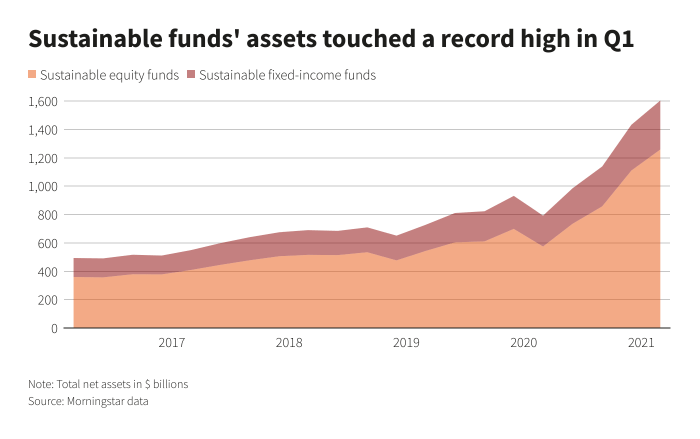

Sustainable investing focuses on making financial investments in companies or projects that prioritize environmental, social, and governance (ESG) factors alongside financial returns. This approach has gained significant traction in recent years as investors increasingly seek to align their values with their investment decisions, leading to a shift in global investment trends towards sustainability.

Growing Popularity of ESG Factors

ESG factors are becoming integral to investment decisions as more investors recognize the importance of sustainability in long-term value creation. Companies that prioritize ESG considerations are viewed favorably by investors looking to invest in businesses that are not only financially sound but also socially responsible.

Companies Leading in Sustainable Global Investments

Some notable examples of companies leading the way in sustainable global investments include:

- 1. Tesla – Known for its commitment to renewable energy and electric vehicles, Tesla has reshaped the automotive industry with its sustainable approach.

- 2. Unilever – A pioneer in sustainable business practices, Unilever has been recognized for its efforts in reducing environmental impact and promoting social responsibility.

- 3. Ørsted – A Danish renewable energy company, Ørsted is at the forefront of offshore wind energy development, demonstrating the viability of clean energy investments.

Long-term Benefits of Sustainable Practices in Global Investments

By incorporating sustainable practices into global investment strategies, investors can benefit from:

- 1. Enhanced reputation and brand value, attracting socially conscious investors.

- 2. Mitigation of risks associated with environmental and social issues, safeguarding long-term returns.

- 3. Contribution to a more sustainable future, aligning investments with global goals such as climate action and social equity.